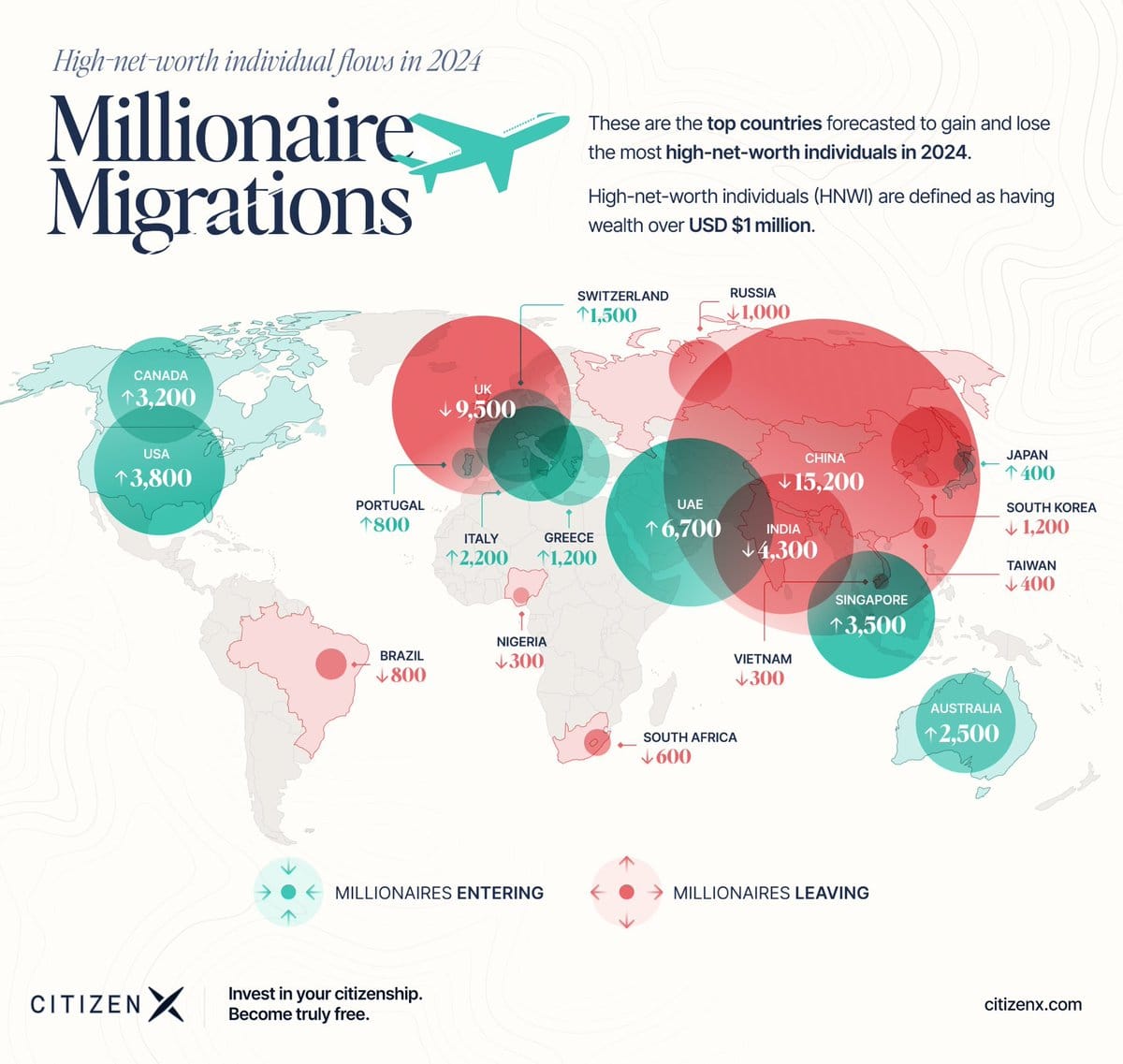

There are only two places where governments are capable of consistently attracting investors from around the world.

Singapore and the UAE.

These governments are trusted every year by thousands of high-net-worth individuals who decide to move there every year seeking freedom, privacy, and safety [1].

Singapore and Dubai are the perfect examples of cities built around private businesses and capitalists. Show me the incentives and I'll tell you the outcome.

Listen to Pavel Durov on why he chose Dubai to build Telegram:

1. Hiring and ease of doing business

2. Tax-efficient system

3. Great infrastructure

The most important: the UAE is a neutral country. It's the best place to defend privacy and freedom of speech.

Pavel Durov on why he chose Dubai to build Telegram:

— Alex Recouso (@alexrecouso) June 11, 2024

1. Hiring and ease of doing business

2. Tax-efficient system

3. Great infrastructure

The most important: the UAE a neutral country.

It's the best place to defend their users' privacy and freedom of speech. pic.twitter.com/i6ZZuUiZVu

That's what Switzerland used to be known for. Now, it's Dubai and Singapore.

These capital flows are a leading indicator of economic success. The smart money takes advantage, and the knowledge, technology, and investments they bring create a flywheel of prosperity.

It happened in the US during the pre-pandemic era. It will happen in small sovereigns that offer the right incentive for individuals and businesses to invest their time and money there.

The trend is clear, and I'm excited to see other types of incentives working as well.

El Salvador is trying to get the monetary incentives right (recognizing #Bitcoin as legal tender), plus offering safety, a tropical lifestyle, and citizenship to investors who put their capital where their mouth is.

We're offering 5,000 free passports (equivalent to $5 billion in our passport program) to highly skilled scientists, engineers, doctors, artists, and philosophers from abroad.

— Nayib Bukele (@nayibbukele) April 6, 2024

This represents less than 0.1% of our population, so granting them full citizen status, including…

Argentina can also have a bright future, especially by staying neutral (read avoid becoming a NATO partner) and maximizing free trade. Milei already has the attention of the technological elite, now it's a matter of getting the incentives right.

Meanwhile, the legacy western nation states are taxing their citizens to poverty:

🇨🇭 Switzerland froze its residents' funds based on political groundings.

🇳🇴 Norway increased its wealth tax to bring an additional $146M in yearly tax revenue, but instead, individuals worth $54B left the country, leading to a lost $594M in yearly wealth tax revenue.

🇳🇴 The recent wealth tax increase in Norway was expected to bring an additional $146M in yearly tax revenue.

— CitizenX (@CitizenX) June 3, 2024

Instead, individuals worth $54B left the country, leading to a lost $594M in yearly wealth tax revenue.

A net decrease of $448M+ ↓ pic.twitter.com/9KTndm2BtZ

In the post-2020 world, we will witness the inevitable rise of small sovereign enclaves, as havens of freedom and prosperity – while the authoritarian powers keep trying to prevent their citizens from voting with their feet.